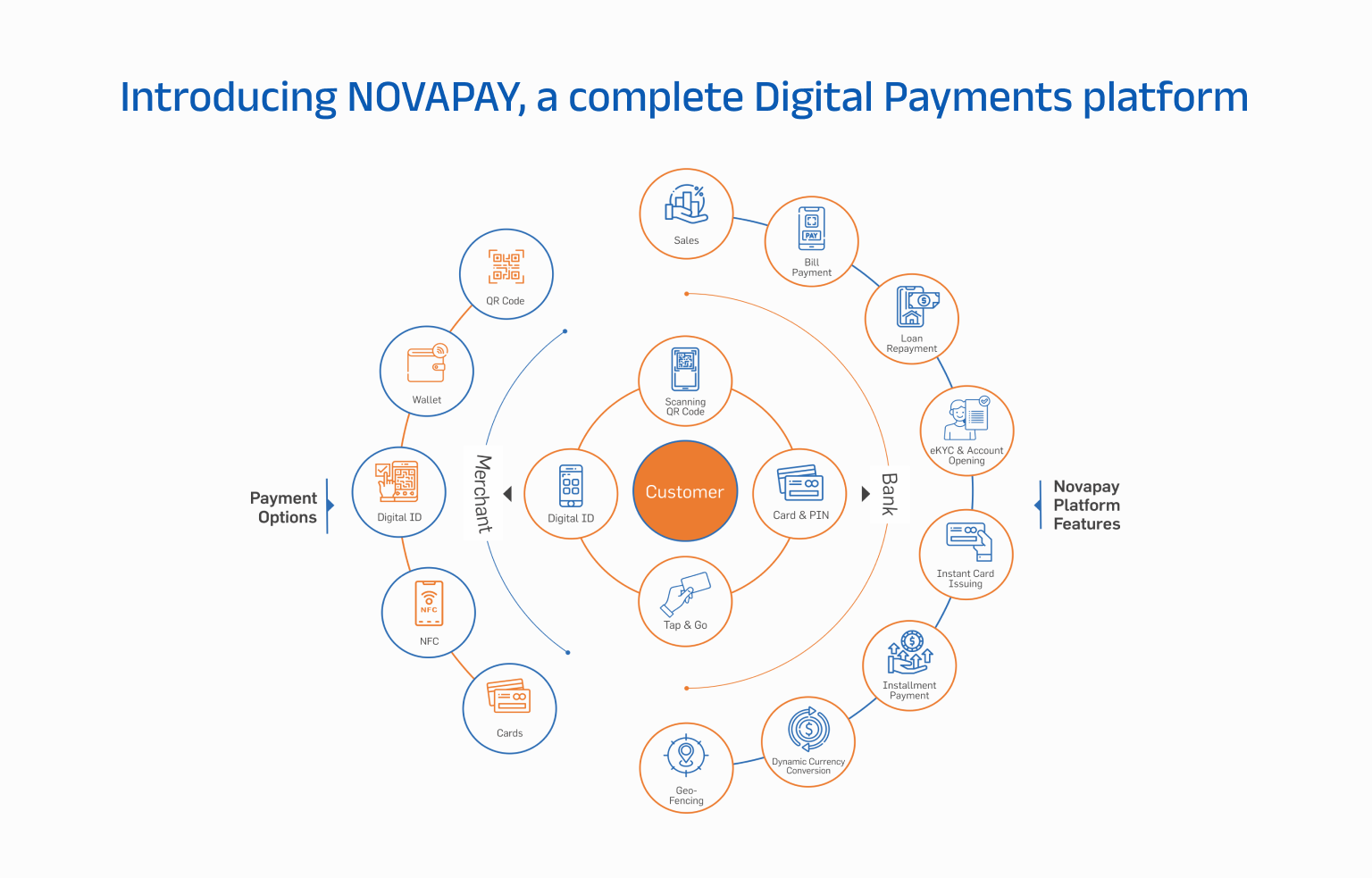

We are your trusted partner in transforming the banking and retail landscape through our cutting-edge digital payment solutions. With a relentless dedication to innovation and a deep understanding of the financial industry, we empower banks, financial institutions, and retailers to embrace the digital revolution with confidence. Our tailored solutions are designed to seamlessly integrate into existing banking systems, providing a secure, efficient, and user-friendly experience for both customers and institutions. By leveraging our comprehensive NOVAPAY platform, we enable institutions to offer diverse payment options, enhance customer engagement, and streamline financial operations. Your success is our priority, and together, we are shaping the future of digital payments.